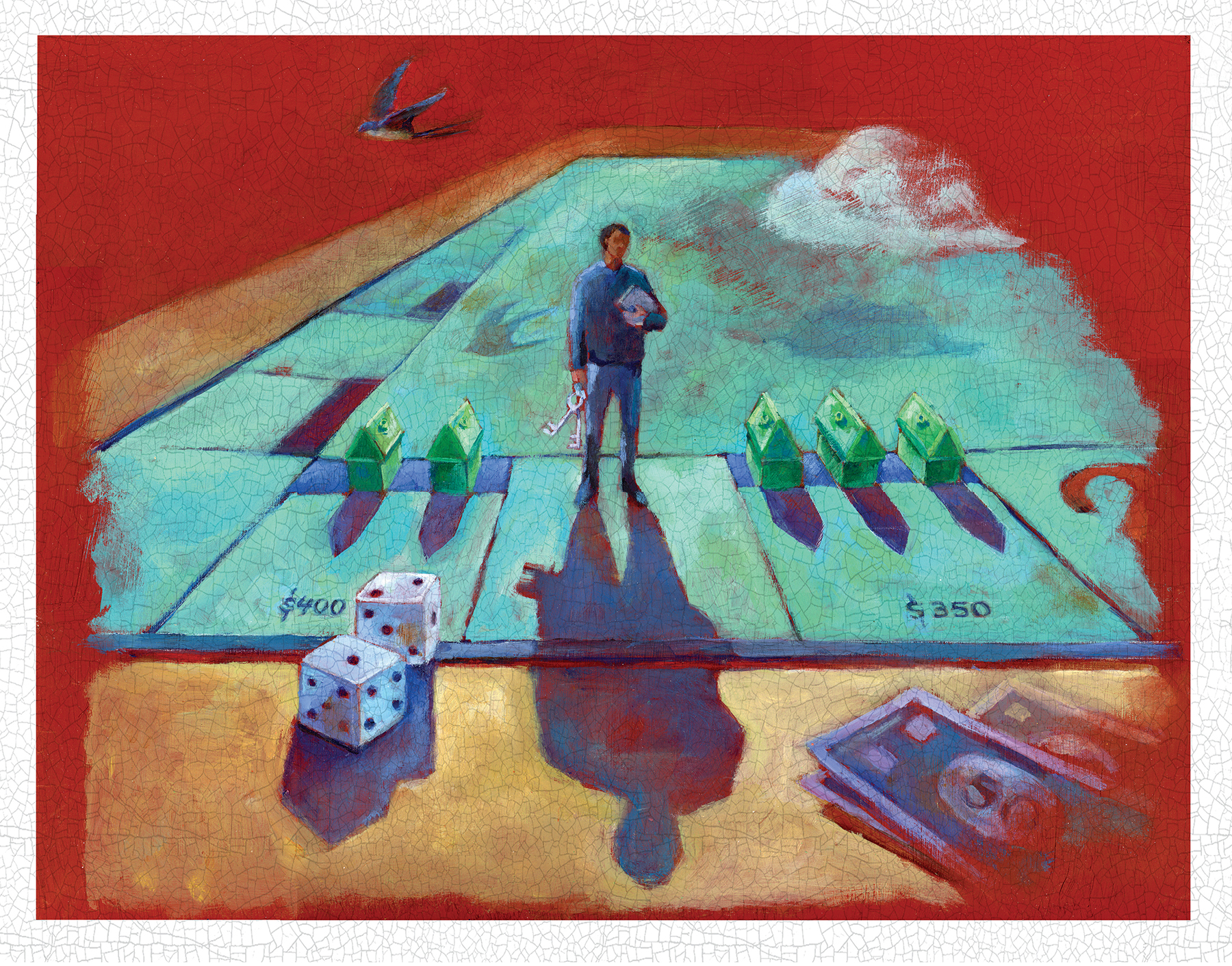

Real estate for wealth creation

stories by Marg Scheben-Edey

illustrations by Shelagh Armstrong-Hodgson

In generations past, simple home ownership was a goal for the average Canadian. Over time, people could reduce their mortgage and eventually own their home outright with any equity gains being 100 per cent tax free. People dreamed of having a debt-free retirement life with a company pension that would see them through.

Today, with economic volatility, disappearing pensions and inflation making it increasingly difficult to save for retirement or to simply get ahead, many people have become real estate investors by employing a multitude of strategies to accomplish their goals. Southern Georgian Bay has become a mecca for many of these people who see the area as one that is ripe for investment on many fronts.

Consistently ranked as one of the top areas of the country to live in, Southern Georgian Bay has enjoyed property appreciation of over 100 per cent in the last decade. That in itself, when adjusted for inflation, is inadequate to generate wealth.

With economic volatility, disappearing pensions and inflation making it increasingly difficult to save for retirement or to simply get ahead, many people have become real estate investors by employing a multitude of strategies to accomplish their goals.

However, it does create opportunities to leverage equity by refinancing property to free up cash for other purchases. With sustained and historically low interest rates, many homeowners have accessed that equity to buy, renovate, flip, rent or invest in real estate through one method or another.

First-time Home Buyers

Having the opportunity to build equity starts with being able to buy a home in the first place. As property values have soared, this has become increasingly difficult for first-time home buyers. Consider the example of two people, each making $40,000 a year (about $20 per hour) and with no debt. Currently, they would qualify for a home purchase price of just over $400,000. This also presumes that they have over $50,000 cash available for a down payment and legal fees.

While home ownership is possible, there are a very limited number of houses for sale in that price range, and the ones that do exist often require substantial work or renovation. Condos have increasingly become an option with their lower price points, but once condominium fees are factored in, the qualifying purchase price drops below $400,000. So what are first-time buyers to do?

Two federal government programs exist that may help buyers with their first home. One is the First-time Home Buyers’ Plan that allows people to borrow up to $35,000 from their RRSP to put toward the purchase of a home. If they are buying with someone else who qualifies as a first-time buyer, they can also borrow $35,000 for a total of $70,000. They then have 15 years to repay the amount back into their RRSP without tax penalties.

A second program is the First Time Home Buyer Incentive, in which the federal government essentially becomes a shared equity partner in the home.

For buyers who qualify, the government puts up five per cent of the price of a resale home, or either five or 10 per cent of the price of a newly constructed one. The incentive is interest-free and is registered as a second mortgage on the title of the property. While no regular principal payments are required, the loan must be repaid within 25 years of the date borrowed or when the home is sold, whichever comes first. While the loan is interest free, it’s a shared equity mortgage, which means the government shares in any gains or losses on the property value. The total borrowing amount cannot be more than four times the qualifying income and is capped at an annual income of $120,000.

The ‘Bank of Mom and Dad’ is another common source for first-time buyers. Parents or others may gift a chunk of cash to the home buyer to assist with a purchase, or they may hold the entire mortgage on the property with reduced rates or easy terms. More families look to this option as an early transfer of wealth that may help their children enter into the real estate market.

Co-ownership is also increasing in popularity, in which two or more parties decide to buy a property together. They may all reside in the home or they may have shared equity arrangements instead. This is a complex area when it comes to mortgage financing, legal agreements and other insurance or regulatory requirements, but it can be done with appropriate legal guidance and defined exit strategies for when one party wants out.

Expanding the search criteria for a property is another option. Instead of buying a detached house, consider other options such as a condominium, townhome or semi-detached house. Looking in a wider geographic area may also be of benefit. For example, according to the Canadian Real Estate Association data, the median price of a single-family home in Collingwood on the Multiple Listing Service (MLS) at the end of 2020 was $653,500, while a townhouse in Wasaga Beach had a median sale price of $425,000.

Another option for qualified first-time buyers is to purchase a home with an income suite or with the ability to create one, as the rental income will increase a buyer’s borrowing power. The rental income from the unit will usually carry more than the increased mortgage payment on this more expensive home. Co-investors or parents taking an equity position may be able to help with the increased down payment or renovation costs.

With sustained and historically low interest rates, many homeowners have accessed equity to buy, renovate, flip, rent or invest in real estate through one method or another.

Conversions & Accessory Suites

Kelly Caldwell, owner of Elevated Wealth Creation, moved to Collingwood three years ago, buying her first property and converting it to a two-unit home with a basement apartment. With rental vacancy rates below one per cent in the area, she saw a strong demand for this type of housing and says there is still no shortage of qualified tenants in the area. She leverages equity created through her renovations to finance other purchases and repeats the formula again. Her ventures have worked for her and bring double-digit returns while also creating much needed rental housing stock.

Today, she owns or co-owns over 20 rental units and is teaching others how to do the same.

Caldwell says finding properties that make financial sense for her model isn’t always easy. “I have had to put a lot of hours into understanding how to strategically analyze return on investment, the Ontario Building Code and the various municipal bylaws, as well as training and educating my contracting team,” she says.

She also offers advice on how to be a successful landlord: “From a property management perspective, we separate ourselves from a more traditional property management approach in that our landlord/tenant relationship begins with us operating from the Law of Reciprocity. Our tenants know they can lean on us at any time and are secure in their knowledge that we will respond in a time-sensitive and appropriate manner.”

Secondary suites are popular and are reported to represent about 32 per cent of Ontario’s rental stock. The Planning Act requires all municipalities to permit second units in homes, although the details of where, what and how are subject to individual municipal bylaws and policies. Homebuyers planning to create such a unit need to carefully research everything involved and consider the time frames for renovation and lack of cash flow during that period.

Alternatively, people buying a home with an existing suite need to make sure that the unit had all required building permits, inspections, fire inspections and the details of any existing leases. In either case, homeowners with secondary suites become landlords and must also become familiar and comply with the Residential Tenancies Act. Research should also be done into both insurance and tax implications.

There may be some financial assistance available to buyers looking to create a secondary suite. Through programs such as a “purchase plus improvements” mortgage, some mortgage lenders will arrange a higher mortgage that covers some of the costs of renovations subject to the anticipated new value of the property after renovations are complete.

In addition, funds may be available to assist with conversion costs through programs such as Simcoe County’s Secondary Suite program. Financial assistance of up to $30,000 is potentially available to qualified homeowners to create a secondary or garden suite. Money is given in the form of a 15-year forgivable loan and rents must be kept within a pre-defined range deemed to be affordable.

In some municipalities, there may also be other incentives available such as the Secondary Suite Program administered by the Blue Mountains Attainable Housing Corporation. This program provides financial assistance in the form of a grant of 10 per cent of the cost to create a secondary suite to a maximum of $5,000 and is generally available on a limited-time basis.

Another option for qualified first-time buyers is to purchase a home with an income suite or with the ability to create one, as the rental income will increase a buyer’s borrowing power.

Property Flipping

In recent years, there has also been an explosion of people wanting to ‘flip’ homes, as they see others doing successfully on many of the popular TV shows. The idea is to find properties that may be in poor condition in good locations and that have the opportunity to sell for a higher price than the original cost of acquisition and renovations.

Over the past decade, Jason Sims has done just that but says it is no longer as easy as it once was. Sims started by building and selling new homes, then started renovating and renting out others. He found it took patience and skill to deal with tenants so he shifted to buying low-priced, resale homes with “good bones,” renovating them and then reselling them at a price that first-time buyers could afford.

“First-time buyers were the ideal target group for my model but today, it is almost impossible with higher prices,” says Sims. For an investor, the higher house and renovation prices increase the risk and make it harder to make a profit. Sims maintains that the traditional property ladder for first-time buyers is gone and flipping homes for or by first-time buyers is not really an option anymore.

Another popular strategy has been the business of short-term rental units, where owners rent out a room or suite for less than 30 days at a time to the travelling public through sites such as Airbnb or Vrbo.

Short-term Rentals

Another popular strategy has been the business of short-term rental units, where owners rent out a room or suite for less than 30 days at a time to the travelling public through sites such as Airbnb or Vrbo.

This is a complicated process as these uses are regulated in most areas and in some cases banned all together. The policies also change over time, creating new challenges for owners relying on this type of income. In addition, standard rental offering of short-term rentals was prohibited during COVID lockdowns.

In The Town of The Blue Mountains, short-term accommodations (STA) are governed under a complex licensing bylaw that may permit STAs in a limited geographic region, generally condos around the base of Blue Mountain. Owners need to obtain a licence to operate which requires meeting a number of criteria around health, safety, fire code requirements, occupancy limits and property management.

In the town of Collingwood, STAs are banned outside of bed and breakfast type operations in a home occupied by the homeowner or in commercially zoned properties that permit hotel-type accommodations. In Wasaga Beach, short-term rentals are only permitted in areas with a tourist commercial designation or commercial accommodation zoning.

Joseph Voeller owns Hosting Blue Property Management, a company that manages short term rental units on behalf of owners. He says he has seen rapid growth and high demand for services such as his. Since opening its doors in 2019, Hosting Blue now manages over 40 short-term rental properties in the area.

“Owning a short-term rental comes with some great advantages, most notably a higher overall ROI and the ability to use the investment as a vacation home,” says Voeller. He adds that this segment of the market has had very high demand in the last year. While there are still properties that can work financially, they are not as readily available as they once were, so it’s important for potential buyers to vet the financial feasibility of a project before buying.

There are other ways people can use real estate for wealth creation. This may be through investing in private mortgages or by investing in real estate investment trusts (REITS). Others invest through real estate crowdfunding services like Addy, where people can invest as little as $1 in shared ownership of properties. There are other new and emerging Proptech companies appearing all the time, such as Lendl where investors provide downpayment funds in exchange for an equity share in properties.

While prices, regulations and bylaws can make it challenging to invest in real estate through traditional models, rest assured the investment market is alive, well and innovative. Best advice if you’re thinking of jumping into the fray: do your homework! ❧